Out of pocket expenses

Out of pocket expenses

The out of pocket (OOP) expenses endorsement enables community pharmacy contractors to claim payment, where in exceptional circumstances, the contractor has incurred expenses in obtaining eligible products (see chart below) and where the product is not required to be frequently supplied by the contractor.

The out of pocket (OOP) expenses endorsement enables community pharmacy contractors to claim payment, where in exceptional circumstances, the contractor has incurred expenses in obtaining eligible products (see chart below) and where the product is not required to be frequently supplied by the contractor.

Eligibility

The products on which OOP expenses can be claimed are as follows:

|

|

|

|

* The ‘SP’ fixed fee for dispensing unlicensed specials and imports is a separate arrangement (see Part IIIA of the Drug Tariff). More information can be found here.

Only actual costs incurred during the process of obtaining specific items to fulfil specific prescriptions can be claimed. This includes costs such as:

- Postage and packaging;

- Handling; and

- Cost of phone calls to manufacturers or suppliers to order products.

It is important that any charges incurred can be linked back to an order for a specific product on a specific prescription.

VAT can be included in an OOP claim as long as the normal criteria for claiming expenses are met i.e VAT can be claimed on expenses incurred in obtaining that product and not on the cost of product.

Minimum thresholds

OOP expense claims are subject to a minimum threshold of 50p, but once the threshold has been reached those claims will be paid in full; therefore, claims need to total 51p or more to be accepted.

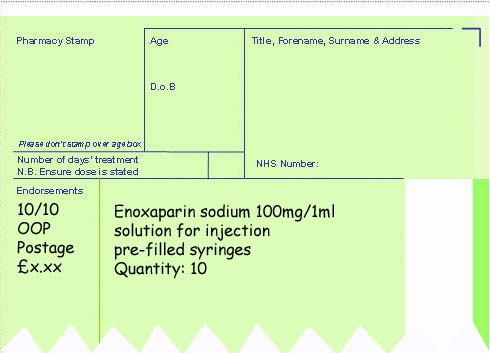

Endorsements

To ensure payment, contractors must endorse:

- ‘OOP’ or ‘XP’ for paper prescriptions;

- ‘XP’ for electronic prescription submissions;

- Details of the claim being made (e.g. postage and packaging); and

- The total amount being claimed (see example below).

Sorting and submission

Prescription forms with OOP expense claims need to be separated and placed in the red separator before submission.

Record keeping

Contractors may wish to keep a log of all OOP claims for audit purposes.

Documentary evidence of the claim should not be sent to the Pricing Authority; however, it is recommended that evidence to support the claim, for example the receipt or invoice, is stored in the pharmacy in case of any query or investigation.

Schedule of Payments

Details of the total OOP claims paid by the Pricing Authority will appear on the FP34 Schedule of Payment.

Re-charging

Individual OOP claims are recharged to the prescriber’s CCG budget . This is to increase transparency around payment of these claims and to ensure that each CCG is accountable for the charges associated with prescribing within their locality.

Minimum order surcharges

Some suppliers levy charges where a minimum spend threshold has not been met. Where it is not possible to avoid incurring a minimum order surcharge, PSNC’s view is that this could be claimed as an out of pocket expense, but only in exceptional circumstances. However, where a contractor can reasonably be expected to routinely order a range of low volume products from a wholesaler, in order to bring their value of purchases above the minimum threshold, our advice is that they should attempt to do this, as there is a substantial risk that routine orders would not satisfy the description of ‘exceptional circumstances’.

It is important that contractors have clear, auditable procurement policies in place in order to demonstrate that minimum order surcharges or delivery charges are avoided where possible.

FAQs

Q. Can I claim Out of Pocket expenses for Dermacolor Fixing Powder?

Yes, in exceptional circumstances where the pharmacy has been unable to obtain the product without incurring additional expenses, this item is eligible for Out of Pocket (OOP) expense claims (see picture opposite).

Yes, in exceptional circumstances where the pharmacy has been unable to obtain the product without incurring additional expenses, this item is eligible for Out of Pocket (OOP) expense claims (see picture opposite).

Products eligible for OOP expense claims are as follows:

- Part VIIIA Category C

- Readily available medicinal products outside of Part VIIIA (including ACBS products)

- Part IXB

- Part IXC

Q. What should I do if I can’t obtain a Part IXA appliance without extra charges?

Products listed in Part IXA and IXR of the Drug Tariff are not eligible for OOP expense claims.

In order to list a product in the Drug Tariff, manufacturers must declare that their product “will be readily available to dispensing contractors either through the normal wholesale network or on equivalent terms” so if a product is unavailable without additional charges from either the manufacturer or the wholesale network, the manufacturer may not be meeting the requirements for their product to remain listed in the Tariff. Please report any products in this scenario to the PSNC Dispensing and Supply Team (0203 1220 810 or email info@psnc.org.uk) who will investigate and, where necessary, escalate the problem to NHS Prescription Services.

As it can take time to reach a resolution with appliance manufacturers, PSNC recommends considering the following points prior to contacting us to report the problem:

- Where a Part IXA appliance is not available from your usual wholesaler without additional charges, contact the manufacturer to find out whom they supply to and whether it is possible to obtain the product directly without charge.

- Alternatively, discuss the problem with the prescriber and consider requesting a new prescription for an equivalent product which is available without additional charges.

- As a last resort, NHS pharmacy contractors are not contractually obliged to supply appliances that would not normally be supplied in the course of their business. Therefore, if a contractor is faced with making a financial loss through dispensing an appliance, they may choose not to dispense it.

Q. How can I claim extra charges for unlicensed special and imports?

Reimbursement of charges related to the sourcing of unlicensed specials and imports falls under the arrangements for payment of specials and imported unlicensed medicines introduced in November 2011 (Part VIIIB of the Drug Tariff).

The ‘OOP’ or ‘XP’ endorsement cannot be used on prescriptions for unlicensed specials and imports. Instead, contractors are entitled to claim the fixed fee (currently £20), which is to cover the additional costs associated with procuring both Part VIIIB and non-Part VIIIB listed specials. The fee is paid when the prescription has been endorsed with ‘SP’ (or ‘ED’ for extemporaneously dispensing the item).

Q. Can I claim staff costs as an out of pocket expense?

No, staff costs should not be claimed as an out of pocket expense. A current issue is the branded medicine supply problems. Community pharmacy teams work extremely hard to ensure patients get the medicines they need; where shortages occur this often involves spending additional hours sourcing required products from wholesalers and manufacturers. The funding settlement recognises and allows for costs associated with this time and resource.

Q. Can I claim a fuel surcharge as an OOP expense?

As wholesaler fuel surcharges are levied once a month to customer accounts, this does not relate to a specific product or order, and therefore it is not possible for pharmacy contractors to claim this fee back under the OOP arrangements. PSNC has had discussions with the Department of Health and Social Care on this issue. We are working to ensure that fuel surcharges are considered in the general funding arrangements.

Q. I have obtained a product from another pharmacy. This was sent by taxi – can I claim this?

Yes, where in exceptional circumstances, products need to be obtained from another pharmacy to support patient care, the expenses incurred can be claimed. This may include taxi fares or postage and packaging.

Related resources

REF: Drug Tariff Part II, Clause 12

Unlicensed specials and imports